Summary

- PLTR has enormous growth momentum.

- We estimate fair value at $26 and our STRONG BUY price target is $21.

- How we are playing the dip.

As we detailed in our recent piece June Headlines: Data Is Everywhere And So Is Palantir, Palantir (PLTR) has enormous growth momentum right now.

Through their partnership with DataRobot they are making a major play into the retail sector by giving floundering traditional retailers a chance to level the playing field somewhat. Their artificial intelligence-powered demand forecasting modeling offering gives many companies access to capabilities that were previously technically and/or cost prohibitive to them.

Furthermore, they just scored an impressive $18.4 million contract with the FAA. Under the terms of the contract, PLTR will provide a data analytics tool to advance the agency's modernization goals for aviation safety. PLTR alsoreneweda $7.4 million contract with the CDC in June as their outbreak response and disease surveillance solution. On top of that, their recently scored contracts with the National Nuclear Security Administration and Space Force, reveal the strength of their Gotham business.

They also recently extended their partnership with Grupo Global - Latin America's largest media company. All this on top of very strong Q1 numbers communicates unequivocally that PLTR has a strong moat and is accelerating its growth rapidly.

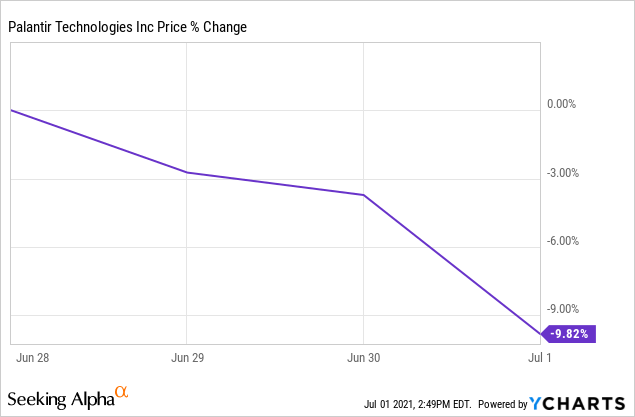

However, despite all of this good news, Palantir Technologies stock has pulled back sharply over the past several days:

Does this signal an opportunity for investors or is it simply a response to the stock becoming overvalued?

How Much Is Palantir Worth?

As we detailed in our piece How Much Is Palantir Worth?, the company still has a long way to grow to justify its current valuation. As a result, the range of potential outcomes (and net present fair values) is quite wide.

However, we have strong conviction that PLTR's world-class brain trust of data analytics, machine learning, and software engineering professionals will be able to out-innovate competitors to position itself well to win an ever-growing amount of commercial business. Furthermore, we also believe that its brain trust will combine with its entrenched existing position in U.S. Government operations to enable it to remain the platform of choice for the U.S. Government as it accelerates its A.I. and data analytics capabilities in its tech race with peer rivals like China.

Furthermore, PLTR enjoys a virtually unlimited growth runway.Estimates indicate that PLTR's current total addressable market is estimated to be ~$120 billion and is forecast to grow at a 20% CAGR through 2030.

Assuming these forecasts are correct, PLTR only has to win 2% of Western commercial market share, 50% of U.S. Government addressable market share, and 20% of allied Western government addressable market share to reach a $1 Trillion market cap by 2040.

If this plays out, PLTR will generate a 16.6% CAGR over that period before accounting for dilution from stock-based compensation. Even after factoring that in, the CAGR should be around 15% which is still phenomenal given how long that period of time is and how low interest rates are right now.

However, given that this involves highly speculative projections far out into the future, we view fair value at $26 per share and our strong buy rating is at $21 per share in order to provide sufficient margin of safety to compensate for the uncertainty.

Our Play

Given that we only like to add to our position at the strong buy price, right now we have a choice of either:

(1) sitting on our hands and waiting for a further correction or

(2) selling puts to generate income while waiting for the stock price to fall to our strong buy price target.

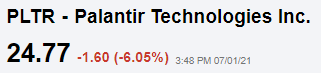

Thanks to the stock's sharp drop in recent days, including today's 6%+ decline:

the implied volatility has shot significantly higher and the margin of safety towards our strong buy price target of $21.00 has declined.

Therefore, the put premiums have once again become attractive. We also note that the bid-ask spreads on the monthly options are much smaller than on the weekly option spreads, so we narrowed down our search to the monthly put options.

The July 16th monthly options at a $21.00 strike price generated only $0.13 premiums, which translated to 16.1% annualized returns. While this is good, it is not great on a risk-adjusted basis given the low absolute return (0.6%).

However, the August 20th monthly options were much more attractive at $0.90 for a $22.00 strike price. This gives us 14.8% downside protection from the current share price of $24.77 and an effective entry price of $21.10 which is roughly in-line with our STRONG BUY price target. Furthermore, if the puts expire worthlessly out of the money, we will earn 4.1% on our capital in 50 days, equating to an attractive annualized return of 30%.

We therefore took this approach and view it as a win-win investment. We will either receive a handsome 4.1% return on our investment over a period of just 50 days or will get to add to our PLTR position at what we view is a highly attractive share price.

Investor Takeaway

PLTR is a great company with world-class artificial intelligence and data analytics technology, a deeply embedded and growing presence in the U.S. Government's (including the Department of Defense's) and their allies' operational infrastructure, and an expanding target commercial market.

Furthermore, they are able to attract among the very best data and artificial intelligence engineering and computer programming minds, giving them a brain trust that should fuel future innovations and enable them to continue capturing market share.

Last, but not least, their growth runway is truly massive and should only continue to grow at a rapid pace. PLTR operates in one of the hottest sectors and is positioned to emerge a major winner in the coming decades.

As a result, we do not want to be too cute about waiting for perfect prices to grow our exposure to the stock and believe it is prudent to take advantage of pullbacks like the current one to build our position further. Thanks to lucrative put premiums, we are able to do so while still guarding against further downside risk.