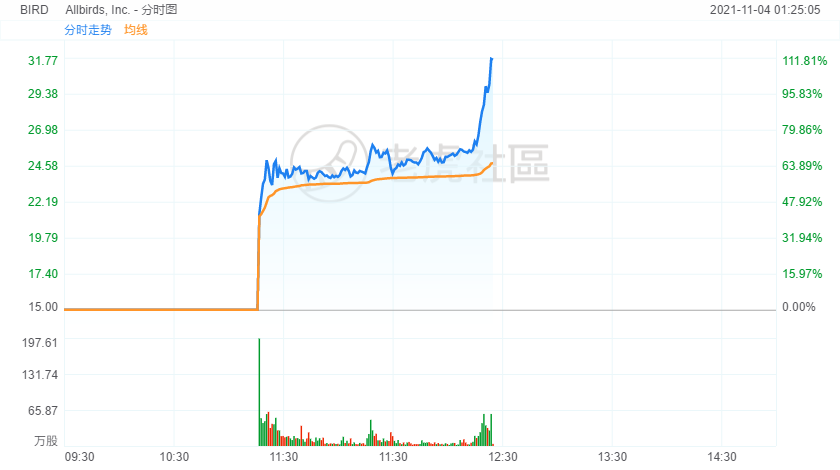

Eco-friendly sneaker maker Allbirds spikes 110% on its first day of trading.

Allbirds, the sustainable shoe company, raised nearly $303 million after increasing the size of its IPO that also priced above its expected price range.

Allbirds said late Tuesday that it sold about 20.2 million shares at $15 each, up from the 19.2 million shares at $12 to $14 each it had planned to offer. At $15 a share, the startup’s valuation is roughly $2.15 billion. It will trade Wednesday on the Nasdaq under the ticker BIRD.

Seventeen investment banks are working on the Allbirds IPO. Morgan Stanley, JP Morgan, and BofA Securities are lead underwriters on the deal, a prospectus said.

Allbirds is one of several highly anticipated IPOs that have or will launch in the fourth quarter.GlobalFoundries (ticker: GFS), a chipmaker, went public last week. GlobalFoundries shares dropped 1.3% from its $47 IPO price during its debut, giving the company a $24.8 billion market capitalization. Rivian, the all-electric truck maker that’s backed by Amazon.com,will trade on Nov. 10. Rivian is seeking a $60 billion valuation. Nubank, the Brazilian digital lender backed by Berkshire Hathaway,has also filed to go public and is targeting a $50.6 billion valuation.

Founded in 2015, Allbirds uses renewable, natural materials to make its footwear. The company’s wool runner sneakers, which it calls the most comfortable shoe in the world, are made with sustainably sourced merino wool. The company’s SweetFoam sole technology, which is found in all of its shoes, uses carbon-negative green ethylene-vinyl acetate. The wool runners sneakers sell for $98 on the Allbirds website while the wool dweller slippers cost $65.