Within the FAAMG peer group, Amazon stock is the only one off its all-time high. The Amazon Maven discusses the buy-on-dip opportunity.

Something atypical has been happening in the world of Big Tech lately. As of the end of August 2021, which was only a couple of days ago, Amazon stock (AMZN) was the only FAAMG name trading off its peak – defined here as 1% or more from the all-time high price.

Could this be a chance for bargain hunters to load up on AMZN? Today, the Amazon Maven talks about the buy-on-dip opportunity in September.

Amazon stock: rare laggard

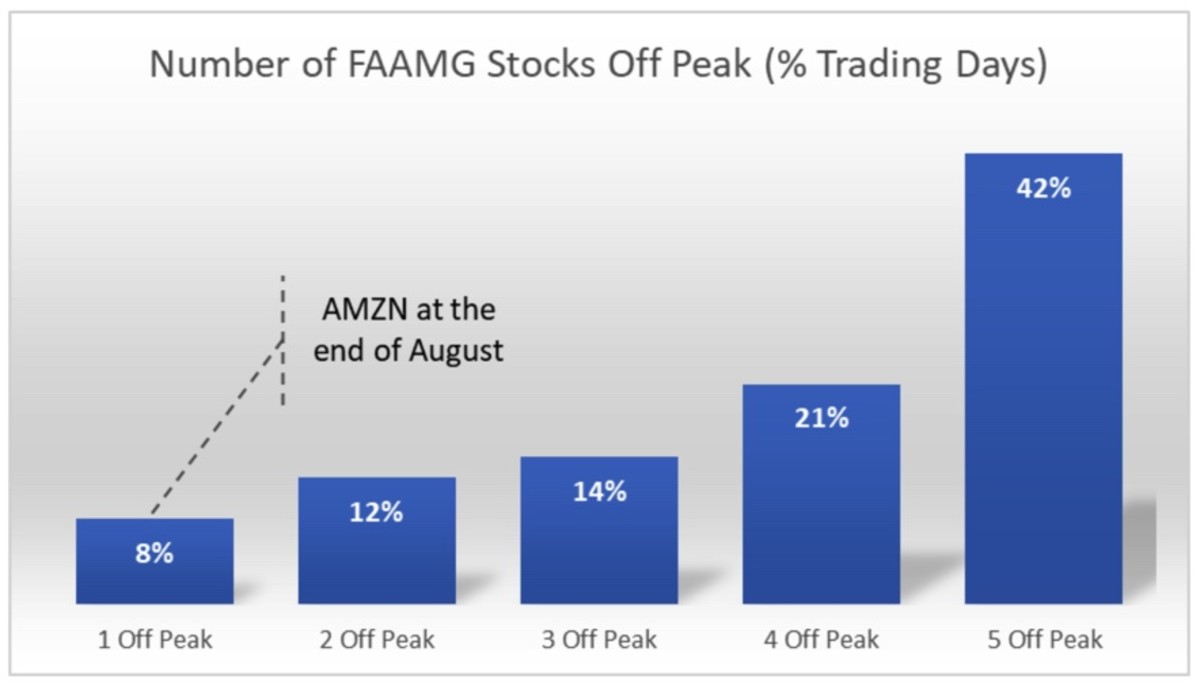

The chart below shows how often the five FAAMG stocks have traded off their all-time highs, in percentage of total trading days, over the past five years. Nearly half the time (42%), all five of them have been at least 1% away from their historical top at once.

This makes logical sense to me. Tech stock prices tend to be volatile and often “peel off” from their highs, even though shares have generally headed higher over a longer time horizon.

The least common occurrence has been for only one FAAMG stock to be in the hole, while all others hover near peaks. This has happened, on average, only 1 out of every 12 to 13 trading sessions (i.e. one day per two or three weeks). This is exactly what was happening to Amazon stock at the end of August.

Once again, this makes intuitive sense. Roughly speaking, FAAMG stocks behave similarly to the macroeconomic and broad market forces. Healthy consumer spending, economic growth, market enthusiasm and low interest rates are all bullish factors across the entire peer group.

Buy-the-dip opportunity

In my view, Amazon’s loser status within the peer group (measured in this case by drawdowns) is still reminiscent of the company’sill-received third quarter earnings report. Back in July, the Seattle-based giant burst analysts’ and investors’ bubble, delivering e-commerce revenues that lagged consensus.

Amazon is not out of the doghouse yet. While COVID-19 fears have lingered, fueling some hopes that the digital retail channel will still perform well in the second half of 2021, the global economies should gradually (and hopefully) reopen and return to “a new normal” over the next 12 months. Therefore, e-commerce headwinds in the foreseeable future are certainly not out of question.

However,history has shown time and again that buying Amazon stock on pullbacks is a good strategy. While the current drawdown of only 5% to 10% may not seem like much,I believe that reasonable valuation shelp to set up AMZN for higher-than-peer group returns over the next several months.