Investors on Reddit, mainly on the forum that participated in a short squeeze in the shares ofGameStop CorporationGME 0.23%, are laying the finger of blame on Wall Street big shots for the plunge that affected several companies Friday.

What Happened: Multiple posts from Reddit users including on r/WallStreetBets bemoaned the unfairness of the situation where retail investors using social media were allegedly blamed for risky trading while institutional investors were the ones that were overleveraged.

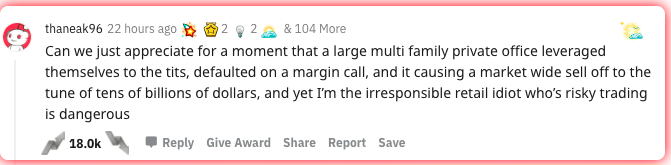

Screenshot: A post on Reddit forum r/WallStreetBets critical of Archegos.

Shares of companies likeDiscovery Communications IncDISCA,Baidu IncBIDU, andTencent Music Entertainment GroupTME, and others plunged on Friday after several major investments banks includingGoldman Sachs Group IncGSforced the hedge fundArchegos Capital Management to liquidate holdings.

Also affected were companies such as ViacomCBS, trading under the name ofCBS Corporation Common StockVIAC, and several Chinese names.

Why It Matters: In January, when the buzz around the short squeeze was at some analysts such as Loop Capital’s Anthony Chukumba compared the actions of the Reddit investors to gambling.

Purpose Investment’s Chief Investment Officer Greg Taylor said the actions of the investors “blurs the line between gambling and investing.”

Some Reddit posters took exception to such thoughts on their style of trading.

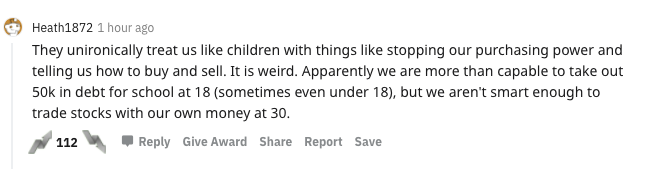

Screenshot: A post on Reddit forum r/WallStreetBets.

Screenshot: A post on Reddit forum r/WallStreetBets

In February, the GameStop shortsqueeze saga reached the Congresswhere, at a hearing, a key WallStreetBets investor Keith Patrick Gill who goes by the handle “Deep F---ing Value” told lawmakers, “in short, I like the stock.”

The lawmakers also heard from CEOs of Wall Street firms such as Robinhood, Citadel Securities, and Melvin Capital who became ensnared in the short squeeze frenzy, one way or another.

At the beginning of February, Rep. Stephen Lynch (D-Mass.)toldCNBC that Reddit-fueled trading wasn’t fair or orderly and posed a “systemic risk.”