Summary

- NIO is launching its cars and battery swap stations in Norway.

- I estimate what NIO's potential TAM could be in Europe and China and offer a valuation based on P/S.

- Despite intense competition, I argue NIO has what it takes to become a global success.

Thesis Summary

NIO Inc.(NYSE:NIO) has become one of the most popular EV companies in China and is now expanding beyond its borders. The first step is to conquer Europe, starting with Norway. In this article, I look at what NIO's TAM is in Europe, and how this could affect its valuation. Ultimately, I believe the company has the right characteristics to penetrate the international market, making me bullish on NIO's prospects.

NIO's International Expansion

NIO is on its way towards capturing the European market, though this will likely be a lengthy process. However, the company began selling its ES8 models in Norway on October 1st, and also recently completed the building of itsfirst power stationin the country.

NIO chose the Norwegian market as a starting point because it is the largest consumer of EVs in Europe. Rival company TeslaInc.(NASDAQ:TSLA)has enjoyed success in the region, and now NIO will try to replicate this achievement. However, it is not just Norway that has an appetite for EVs, and we should soon see the rest of Europe increase its demand.

Here's a forecast courtesy of Allied Market Research:

The Europe electric vehicle market was valued at $25,489.81 million in 2019 and is projected to reach $143,084.57 million by 2027, registering a CAGR of 25.4% from 2020 to 2027.

Source:Allied Market Research

The EV market will be roughly growing at a CAGR of 25% over the next 5-6 years, which is great news for NIO, which is getting in early on the game. The question is though; how will NIO compete with Tesla and major car brands like Volkswagen who are now turning all their attention to EVs?

The EV market is a competitive space, but NIO has what it takes to find itself a nice spot, and I'll explain why below:

Why I believe NIO has what it takes

With everyone's attention now turning to EVs, it is not enough to simply devote money to the sector. During the next few years, companies will reveal themselves to either be winners or losers, and their fate lies in the hands of the ultimate king of the market; the consumer.

In this regard, NIO has already been picked by Chinese consumers for two key reasons which I believe will also guarantee its success in Europe; Strong brand and technology offering.

In terms of brand, NIO has worked hard to associate itself with luxury, convenience and create a strong sense of community. NIO's cars are priced and equipped like high-endcars and William Li himself has said that he sees Audi and BMW as their real competition. In China, and now in Norway, NIO has brought the NIO house concept, which acts as much as a charging station as a ClubHouse for NIO owners. NIO also has an App and a whole section of its website dedicated to lifestyle products and artistic projects. In the past, I compared NIO to AppleInc.(NASDAQ:AAPL). I believe this Apple-style approach will work even better with European consumers.

The other reason NIO has good odds of succeeding in Europe is the fact that it has some of the best EV techs out there, and Europe could also be a great place to successfully implement BaaS. In the past, companies like Tesla have failed to do BaaS, but NIO has managed to make it a success in China, and Europe has the right characteristics. Due to its densely populated cities, BaaS can be more convenient than regular charging stations. NIO's BaaS technology can replace a battery in a matter of minutes, and it also means that the new battery is fully serviced, and could hypothetically be charged with "cheaper" energy.

All in all, NIO's current strengths will translate well to the European market. With that said, the company will have to deal with intense competition.

Competition left and right

The biggest threat to NIO now is that the market for EVs is becoming increasingly competitive, with competition coming from all sides. In recent news, XPeng Inc.(NYSE:XPEV) announced that it was getting ready to launch a new model,the G9, which is specifically geared towards international markets.

Competition is intense in China, and when it comes to Europe, NIO has to also deal with Tesla and legacy car businesses.

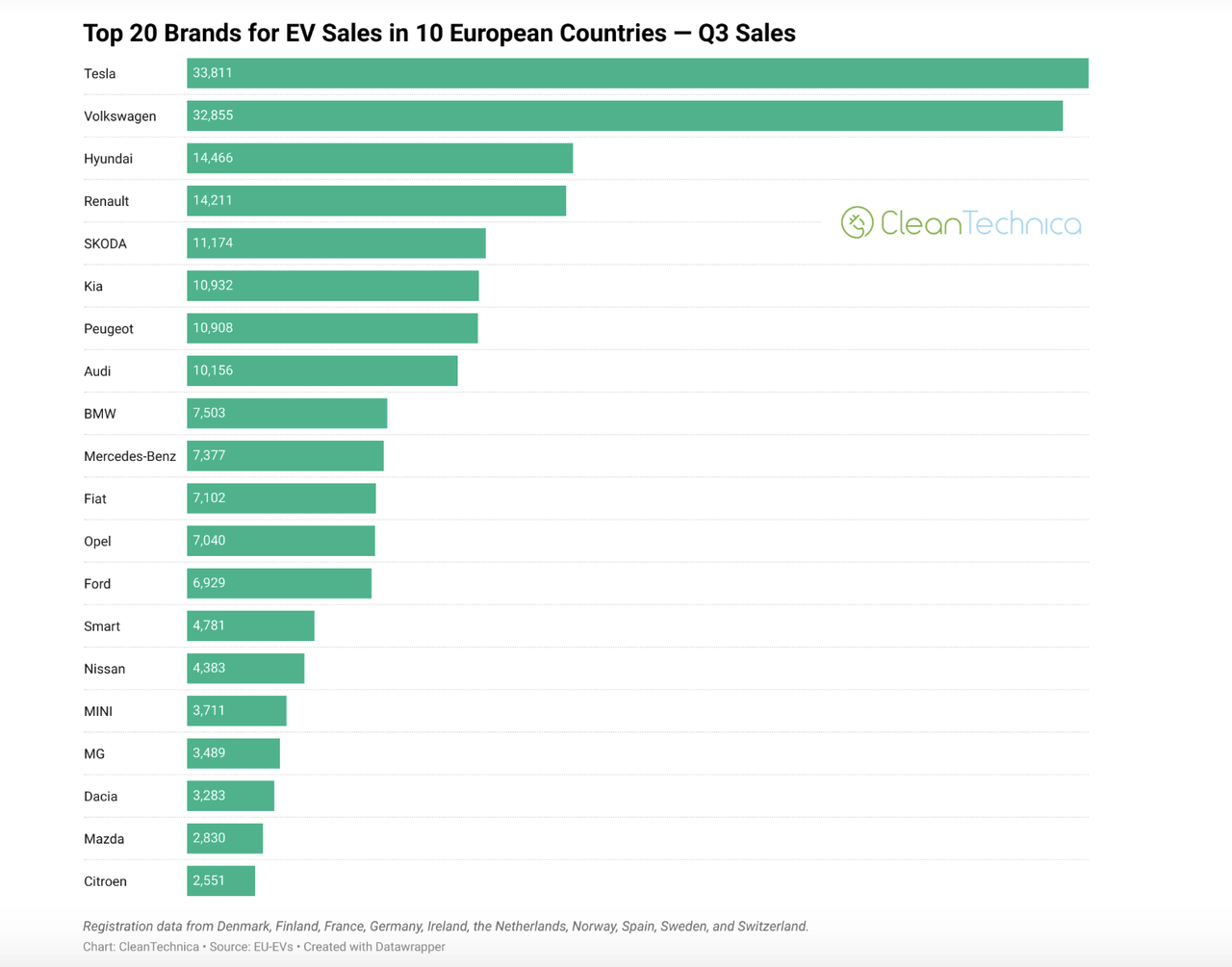

As we can see from the graph above, Volkswagen is a strong contender in terms of European EV market share. Right behind, we have Hyundai, Renault and SKODA. These companies have a strong foothold in the European market, and they are recognized brands.

NIO certainly has its work cut out for it, but with the right approach, I believe it could one day become an investor favorite in Europe.

Forecast and Valuation

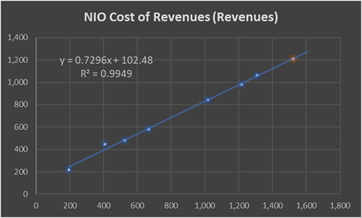

For such long-term growth-prospect companies we are better off making the best possible estimate of revenues and price to sales (PS) ratios in the future and hope that the market will soon share our view. We will, however, give profitability some consideration. In an article published two months ago, we made a projection of gross profitability based on a linear trend that seemed to fit the data very well, and since another quarterly report has been published in the meantime, it would be good to see how it fits those projections.

In our gross margin projection from two months ago, we estimated that cost of revenues had a linear relation with revenues, where the cost was $108 million plus 73% of revenue. With revenue in the third quarter at $1.521 billion, the predicted cost of revenues would have been $1.212 billion, less than a million away from the declared figure of $1.211 billion. While it is true that other operating expenses were higher, with this much growth ahead, the fact that we continue to observe positive and predictable gross margins is comforting. In the chart below you can see the trend from the last 8 quarters and how well this third quarter fits the predicted value.

Moving on to revenues, what I am going to do is forecast NIO's revenues based on two key elements: the actual and forecasted EV market size in China and Europe, and the projection of NIO's market share in each one based on the trend so far in China.

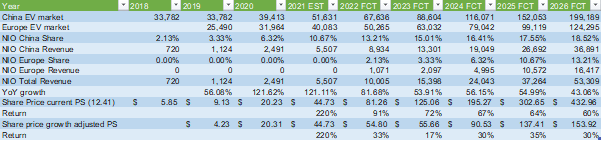

According to the China Association of Automobile Manufacturers, EV sales in China in 2018, 2019 and 2020 were approximately 1.2, 1.2 and 1.4 million vehicles respectively. To estimate market size in dollars, we are using the average price of an EV in China according to wattev2buy.com, which is 180000 yuan, or 28,152 dollars. From 2021 onwards, we are using the forecast from Mordor Intelligence, which is that market size will grow by 31% CAGR until 2027. The resulting forecast for the Chinese market is an increase from under $34 billion in 2018 to almost$200 billion in 2026.

For the European market, we are using the estimate and forecast from Allied Market Research, which says that the market was worth 25.5 billion in 2019, and will grow until 2026 at a 25.4% CAGR.

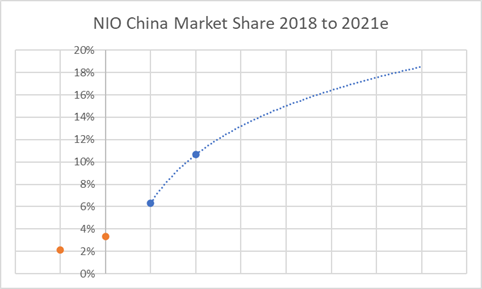

We have obtained NIO's market share by dividing the value of the Chinese market by NIO's revenue in 2018, 2019 and 2020, as well as an estimate for 2021. Going forward we are being cautious and assuming the market share keeps growing but at a slowing rate. We will use a logarithmic trend, as you can see in the chart below, to forecast NIO's market share in China, from its current 2.13% in 2018 to 18.82% in 2026. The forecast for NIO's share in Europe is a delayed copy of the Chinese, with the same percentages as in China only 4 years later, starting at 2.13% in 2022 and ending at 13.21% in 2026.

Multiplying the forecasted market size and the forecasted market share from each region, we get a sales forecast, which predicts revenue to grow up to $53 billion in 2026. With this revenue, we can use PS ratios to forecast the share price. We have made two forecasts, one with the current PS ratio and one with a growth-adjusted PS ratio. You can see a summary of the figures below.

Below each share price forecast, you can see the compound annual return from appreciation based on the current price and date. 2021 is unusually high because we are very close to the end of the year and any fluctuation gives a large annualized percentage. In the long run, it seems like NIO stock should be able to deliver a 30% long-term return.

Takeaway

The EV space is a space that investors have come to love, and within it, I particularly like NIO due to its high growth prospects, differentiated technology offerings and brand. Out of the Chinese EV startups, I believe NIO is the best positioned to compete globally, and once it does, investors will be piling in.