- Combined size of bond, loan offering outweighs United, Delta

- Deal backed by frequent-flyer program will repay Treasury loan

American Airlines Group Inc.has boosted the size and cut borrowing costs on what’s now a $10 billion debt deal backed by its frequent-flyerprogram, making it the largest ever by an airline.

The carrier is now selling $6.5 billion ofbondsand $3.5 billion ofloans, up from $5 billion and $2.5 billion, respectively, according to people familiar with the matter. Each of the bond tranches, which mature in five and eight years, may yield around 5.75% and 6%, respectively, lower than initial discussions in the low-to-high 6% range.

The size of the combined bond and loan offering marks the largest-ever debt sale by an airline. American’s record deal surpasses Delta Air Lines Inc.’s $9 billionsalein September, and a $6.8 billiontransactionfrom United Airlines Holdings Inc.in June.

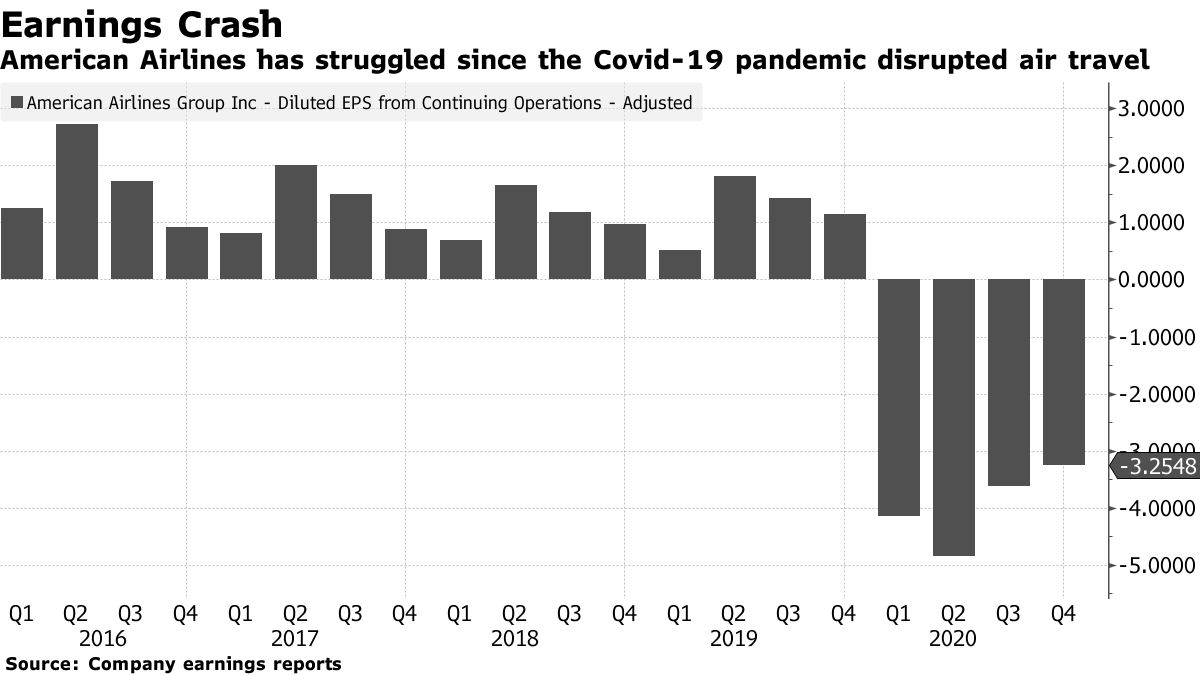

All three used a special structure, pioneered by United, that backstops the debt with the company’s frequent-flyerprogram. Extracting value from rewards programs has become a critical lifeline for carriers that have faced disrupted air travel for more than a year due to the Covid-19 pandemic.

Loyalty programs carry a lot of value -- around $18 billion to $30 billion, inAmerican’s case-- which in part contributes to higher credit ratings on such deals. That’s helped drive investor demand at a time when air traffic levels are still well below the norm. Moody’s Investors ServiceratesAmerican’s new bonds Ba2, or two steps below investment grade, while its corporate issuer rating is three notches lower.

Proceeds from American’s offering will help refinance its $7.5 billion Treasury loan, of which $550 million has been drawn to date, according to an investorpresentationMonday. The remaining proceeds will be used for general corporate purposes.

Books close on the bonds at 11 a.m. in New York on Wednesday, with pricing expected thereafter, the people added, asking not to be identified discussing a private transaction. Commitments on theloanhave been accelerated by one day to Wednesday.

American is returning to the market at a ripe time for borrowers: Funding costs are athistorically low levelsand risk appetite has been soaring as investors rush to get their hands on higher-paying assets. The airline borrowed $2.5 billion in June at an all-in yieldof 12%.