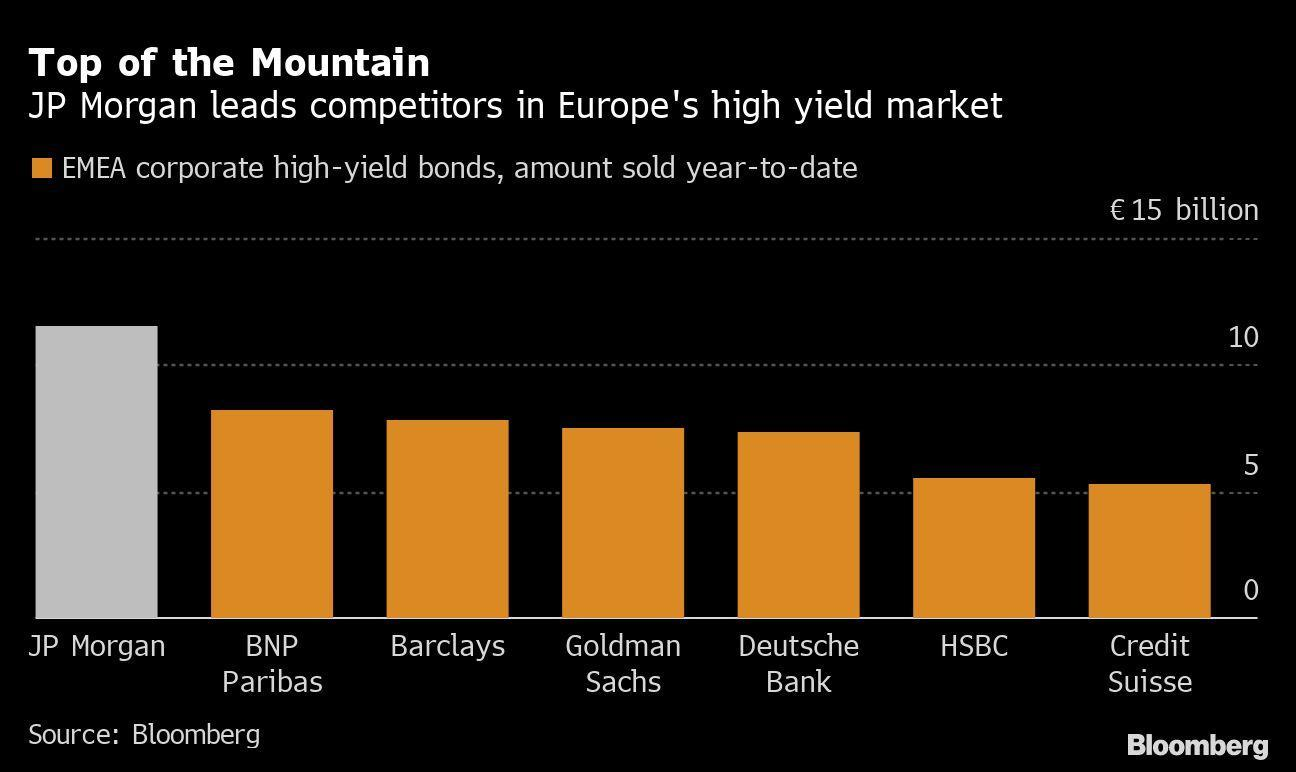

(Bloomberg) -- JPMorgan Chase & Co. has committed more of its balance sheet to European junk bonds and loans than ever before as it bets on continued easy money and transitory inflation.

The bank has underwritten around 43 deals so far in 2021, the most on record, while its bridge loan book is the highest since the global financial crisis, according to Ben Thompson and Daniel Rudnicki Schlumberger, co-heads of leveraged finance for Europe, Middle East and Africa.

JPMorgan is upping the ante even as strategists at HSBC Holdings Plc warn that euro credit markets have become over-priced and buffers too thin to weather shocks. U.S. and European junk bonds are leading returns in fixed-income markets tracked by Bloomberg this year, up 4.7% and 4.5% as investors plow record amounts of cash into the market.

The firm is putting its own capital at stake on a bet that there’s still a lot of juice left in that rally, its bankers said in a phone interview ahead of the lender’s European High Yield & Leveraged Finance Conference on Wednesday. They’re confident that monetary policy will remain supportive amid price pressures that will prove transitory, while companies make the most of rebounding growth by going on an acquisition spree.

When a bank underwrites a deal, it gives borrowers the guarantee that they will not have to pay more than an agreed rate of annual interest. It leaves the underwriting bank on the hook if investors balk.

Similarly, underwriters that extend acquisition financing via a bridge loan assume they’ll be repaid from a refinancing by the borrowers using the balance sheet of the company they’re acquiring.

The bank has a pipeline of 45 deals for September and October, and has underwritten around a third of these deals, according to Rudnicki Schlumberger and Thompson.

They expect these future sales to be absorbed in a year that could tally a new record of about 220 billion euros ($261 billion) in leveraged loans and high-yield bonds.

That’s not to say they’re expecting smooth sailing throughout.

“The calendar is pretty well telegraphed so we’re confident there will be enough demand,” Thompson said. “But of course there’s a worry that when the market is actually confronted with the supply, there could be a short-term back-up.”

M&A activity has partly been driven by stronger companies scooping up weaker firms with broken balance sheets after being dismantled and sold, Rudnicki Schlumberger said. Technology is also a big driver of M&A activity amid fierce competition.

Global private equity dry powder, also including balanced, co-investment funds and turnaround funds, is running at a record $1.74 trillion as of this month, up around 8% from 2020, according to data from Preqin.

“We’ve never seen such an active market and it’s mostly driven by M&A activity,” Rudnicki Schlumberger said. “We’ve been going all guns blazing in underwriting client risk.”

Europe

Europe’s bankers continued to fire out deals on Tuesday with 17 transactions expected to price in the region’s primary market.

Spain is poised to test investor demand for green sovereign paper with its first visit to Europe’s ethical publicly syndicated bond marketThe nation is seeking to raise 5 billion euros ($5.9 billion) by offering a bond maturing in 2042 via banks TuesdayMORE: Spain Joins Green Rush With Debut Sovereign Bond Offering (1)Elsewhere, Deutsche Telekom agreed to sell its Dutch unit to Warburg Pincus and Apax Partners for 5.1 billion euros, one of its largest divestments in recent years

Asia

Asia’s primary bond market started slowly with just a handful of new issues poised to price this week.

KWG Group sold additional $100 million 5.95% notes due in 2025 on Tuesday, while borrowers including Power Finance Corp and DBS Group are among those marketing new issues this week

U.S.

A handful of dollar deals were announced on Tuesday morning following the U.S. Labor Day holiday.

$Royal Bank of Canada(RY-T)$ is marketing a dollar benchmark-sized five-year covered deal, while Kommuninvest readies a $1 billion four-year transaction