沉浸式翻译双语阅读 | 特斯拉盈利预览:房间里有一头大象

Summary 摘要

Tesla, Inc. reported record sales in Q2, with China accounting for over half of the automaker's global sales. However, domestic competitors in China are gaining ground on Tesla. $特斯拉(TSLA) 公司报告称,第二季度销售创下纪录,中国市场占该汽车制造商全球销售的一半以上。然而,中国国内的竞争对手正在迎头赶上特斯拉。

Investors are looking to Tesla's Q2 earnings report, expected on 19 July, with concerns over operating margins and the impact of price cuts on revenue. A further drop in margins could push the company into negative cash flow territory. 投资者正在关注特斯拉的第二季度财报,预计于7月19日公布,担心运营利润率和价格削减对收入的影响。利润率进一步下降可能会使公司陷入负现金流领域。

Tesla's valuation could be impacted by protectionism and nationalism, with questions over how China will tolerate overseas competitors in its electric vehicle market. There is also potential for Chinese brands to encroach on European markets. 特斯拉的估值可能会受到保护主义和民族主义的影响,对中国如何容忍其电动汽车市场上的海外竞争对手存在疑问。中国品牌也有可能侵占欧洲市场。

Tesla, Inc. (NASDAQ:TSLA) will soon release its latest earnings after another record for deliveries. Here I discuss the outlook for the Tesla balance sheet and the valuation outlook. 特斯拉公司(NASDAQ:TSLA)将在创下交付记录后不久发布最新的财报。在这里,我将讨论特斯拉资产负债表和估值前景。

Record deliveries in China, but the competition is growing 中国的交付数量创下了纪录,但竞争也在增加

Electric vehicle pioneer Tesla reported its latest production and deliveries last week with another record for sales in the second quarter. The company reported deliveries of 466,140 units, for a 10.2% improvement over the first quarter. 电动汽车先驱特斯拉上周公布了其最新的生产和交付情况,第二季度销售再次创下纪录。该公司报告称,交付了466,140辆车,较第一季度提高了10.2%。

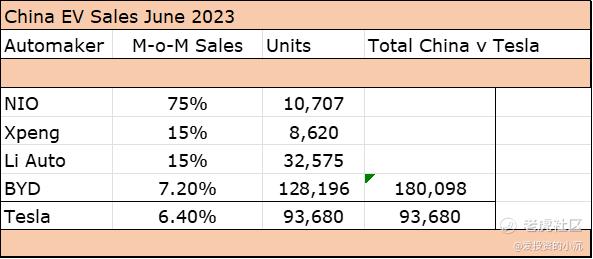

The standout from this report was wholesale deliveries of 93,680 in China, where the country now accounts for more than half of the automaker's global sales, according to data from the China Passenger Car Association (CPCA). Yearly data adds a ribbon to the figures with a 120% jump over the same quarter a year ago, with June sales growing 19% for the same month last year. 根据中国乘用车协会(CPCA)的数据,这份报告中最引人注目的是中国的批发交付量达到了93,680辆,该国现在占据了该汽车制造商全球销售额的一半以上。年度数据显示,与去年同期相比,这一数字增长了120%,而6月份的销售额较去年同月增长了19%。

However, the reality is that Tesla's Chinese domestic competitors are gaining ground on the company. Four domestic competitors outsold Tesla by a factor of almost 2:1. Month-on-month gains also saw the Austin-based firm at the bottom of the pack, with a 6.4% improvement from May. 然而,现实情况是,特斯拉的中国国内竞争对手正在迎头赶上该公司。四家国内竞争对手的销量几乎是特斯拉的两倍。按月计算的增长也使得总部位于奥斯汀的公司在竞争中处于垫底位置,五月份的销量仅有6.4%的提升。

The figures also don't include 120,000+ hybrid vehicles sold by the Warren Buffett-backed BYD Company Limited (OTCPK:BYDDF). 这些数字还不包括由沃伦·巴菲特支持的比亚迪股份有限公司(OTCPK:BYDDF)销售的12万多辆混合动力汽车。

Tesla's sales in China were good, but there is a growing appetite for domestic vehicles, while the effects of the Tesla price cut strategy have to be considered 特斯拉在中国的销售情况不错,但国内车辆的需求正在增长,同时还需要考虑特斯拉降价策略的影响

What to expect from Tesla's second-quarter earnings? 对特斯拉第二季度的盈利预期是什么?

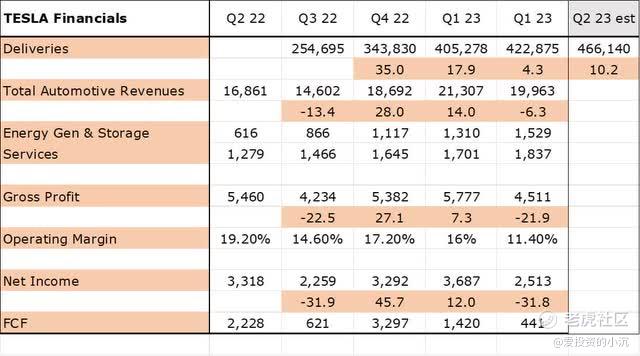

Investors will now look to Tesla's post-market 19 July earnings report for the second quarter to consider the latest deliveries, but it is fairly easy to work out. Tesla's financials over the last three quarters show a lower increase in revenue, compared to deliveries. 投资者现在将关注特斯拉在7月19日发布的第二季度财报,以考虑最新的交付情况,但这很容易推断出来。特斯拉过去三个季度的财务数据显示,与交付量相比,收入增长较低。

Last quarter's 4.3% bump in deliveries saw a -6.3% decline in automotive revenues. The latest figures are likely to remain flat at best despite a 10.2% jump in deliveries. 上个季度交付量增长了4.3%,但汽车收入下降了6.3%。尽管交付量增长了10.2%,但最新数据可能最多保持平稳。

The other problem for this coming quarter is that the company embarked on further price cuts, and this could drag revenue even lower. One benefit for Tesla is that the U.S. dollar has strengthened against the Yuan in that time, and the sales increase could negate some of the lower prices. 这个季度的另一个问题是公司继续降价,这可能会进一步拖低收入。对特斯拉来说,一个好处是美元在这段时间内对人民币升值,销售增长可能会抵消一些价格下降的影响。

The big issue for the second quarter earnings will again be operating margins, which have slipped from 17.2% to 11.4% over three straight quarters. A further drop in margins would likely push the company into negative cash flow territory. The decision over the coming quarters would be whether to halt the price cuts or burn through the company's cash pile. 第二季度收益的重大问题将再次是运营利润率,该利润率已连续三个季度从17.2%下滑至11.4%。利润率进一步下降可能会使公司陷入负现金流领域。在接下来的几个季度中,决策将是停止降价还是消耗公司的现金储备。

The former looks like it will be the case after executives from the largest brands signed a truce over "abnormal pricing" this week. Tesla's sales bump in the first half of 2023 may now start to slow if prices normalize. 在最大品牌的高管们本周签署了一项关于“异常定价”的停火协议后,前者看起来可能会成为事实。如果价格恢复正常,特斯拉在2023年上半年的销售增长势头可能会开始放缓。

Inventory is also an issue for this quarter with Tesla producing excess vehicles for a fifth-consecutive quarter. The cumulative total is 91,000 vehicles at a cost of around $38,000 each or a total of around $3.5 billion. The latest deliveries would add $500 million to that figure. 库存问题也是特斯拉本季度的一个问题,连续第五个季度特斯拉生产过剩车辆。累计总数为91,000辆车,每辆车成本约为38,000美元,总计约为35亿美元。最新交付的车辆将使这个数字增加5亿美元。

Increasing inventory led to a rise in working capital that hurt free cash flow in Q1. 增加的库存导致了一季度工作资本的增加,对自由现金流产生了负面影响。

Protectionism and nationalism is the elephant in the room 保护主义和民族主义是悬而未决的问题

The big problem ahead with giving lofty valuations to Tesla comes in the form of protectionism and nationalism. How will China tolerate overseas competitors in its electric vehicle push? Is the latest surge in Chinese vehicle competition a sign of growing interest in domestic EVs? 给特斯拉高估值面临的一个重大问题是保护主义和民族主义。中国将如何容忍其电动汽车推动中的海外竞争对手?中国汽车竞争的最新激增是否意味着对国内电动汽车的兴趣日益增长?

As for domestic demand, Chinese consumers have relied on overseas brands for forty years, but the tide could be changing. There is also the threat of those brands encroaching on European and U.S. markets. 就国内需求而言,中国消费者在过去四十年一直依赖海外品牌,但现在形势可能正在发生变化。同时,这些品牌也对欧洲和美国市场构成了威胁。

"It would be the best for foreign brands to learn from new Chinese EV startups if they want to survive in China or face the disruptive impact from those brands in their home markets," Stephan Dyer, from consultancy AlixPartners said. "如果外国品牌想在中国生存下来,或者面对这些品牌在本土市场上的颠覆性影响,最好向中国的新能源汽车初创企业学习。"咨询公司AlixPartners的斯蒂芬·戴尔说道。

The company expects annual sales of Chinese cars in overseas markets to grow to 9 million vehicles by 2030. That would result in a global share of 30%, with a 15% share of Europe. Another feature will be consolidation, with analysts at AlixPartners saying only 25 to 30 of the 167 NEV brands can survive by 2030 due to a lack of sales. 该公司预计到2030年,中国汽车在海外市场的年销量将增长到900万辆。这将使其在全球市场占有30%的份额,其中欧洲市场占有15%的份额。另一个特点将是整合,AlixPartners的分析师表示,到2030年,仅有25至30个品牌能够在167个新能源汽车品牌中生存下来,原因是销量不足。

A word on valuation 关于估值的一点说明

Tesla currently has a price/earnings ratio of 83X and a forward ratio of 58X, but those figures could rise with a further stock price surge and a deterioration in earnings per share in the second quarter release. 特斯拉目前的市盈率为83倍,预测市盈率为58倍,但随着股价进一步上涨和第二季度每股收益的下降,这些数字可能会上升。

The stock would also see its price-to-free cash flow ratio expand beyond the current 157X. It was ok to pay those prices when Tesla was ramping up production with little competition, but it is now a mature company and could be facing headwinds with its hold on the China market, which now accounts for 50% of sales. 股票的价格与自由现金流比率也将超过目前的157倍。当特斯拉在几乎没有竞争的情况下扩大生产时,支付这些价格是可以接受的,但现在它是一家成熟的公司,可能面临中国市场的阻力,该市场现在占销售额的50%。

Tesla said that its Q1 delivery ramp was part of an effort to push further into APAC and MENA regions. Coupled with the boost from government subsidies and a price cut strategy, Tesla has reported records for deliveries and increased its share of the Chinese market. With the end in sight for Tesla's price cut strategy, sales could start to stall for the company as Chinese buyers start to have more faith in domestic vehicles. 特斯拉表示,其第一季度的交付增长是为了进一步拓展亚太地区和中东北非地区的市场。在政府补贴和降价策略的推动下,特斯拉的交付量创下纪录,并增加了在中国市场的份额。随着特斯拉降价策略即将结束,随着中国买家对国内车辆的信心增加,该公司的销售可能会开始停滞。

I believe Tesla's earnings and financials could disappoint in the second quarter and investors would be better served considering a rotation into other electric vehicle names. 我相信特斯拉第二季度的收益和财务状况可能会令人失望,投资者最好考虑转向其他电动汽车公司。

沉浸式翻译查看双语原文:https://seekingalpha.com/article/4615612-tesla-earnings-preview-cash-flow-negative-and-an-elephant-in-the-room

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。