台积电跟特斯拉一样每月公布月报,所以财报重点看Q1业绩预期跟2025年整体预期。

2025年整体收入预计增长20%,达1130亿美元。预计2025年Q1销售额为250亿-258亿美元。2025年资本支出预计增长至380-420亿美元。

对于收入增长,机构看法是年度增长会比台积电预期要高,会增长26~30%。

财报数据整体符合分析师预期,机构评级目标价250,所以,继续看涨英伟达!

当然做台积电也一样,不过考虑保证金性价和隐含波动率,还是英伟达性价比会更高一些。

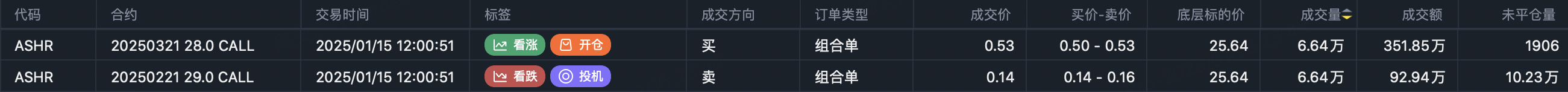

12月10日跟11日成交的单腿看涨大单 $ASHR 20250221 29.0 CALL$ 6.64万手移仓到了3月 $ASHR 20250321 28.0 CALL$

看k线图可以发现,29call的买入价格0.94,平仓价格0.14,爆亏85%。期权价格暴跌的主要原因来自时间损耗。

这单是场内交易,从这次roll仓可以看出,机构是真的很笃定中概会涨,但又怕中概行情磨磨蹭蹭以至于期权等不到2月21日。所以买2026年到期期权某种程度上很合理。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

22

举报

登录后可参与评论

“CoWoS-L process is more complex than CoWoS-S, and capacity continues to grow. It is expected that the overall CoWoS capacity will continue to increase significantly this year.”

When asked by reporters about concerns in the market regarding GB200 server cooling, Jensen Huang pointed out that “the cooling technology of the Blackwell platform is relatively complex. However, the Blackwell system has already entered full-scale production, and the challenges encountered in the initial stages are quite normal given the system’s complexity. The Blackwell system has already begun shipping to global customers.”