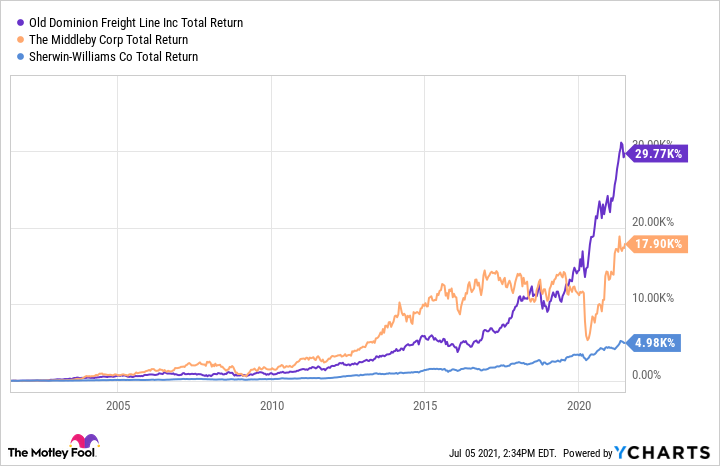

If you had invested $1,000 each in the stock of trucking company Old Dominion Freight Line (NASDAQ:ODFL), food equipment company Middleby (NASDAQ:MIDD), and paint and coatings company Sherwin-Williams (NYSE:SHW) 20 years ago, you would be worth more than $525,000 by now. While it's easy to look at such things in hindsight, perhaps there's value in looking at some of the lessons learned and then applying them to investments now. So with that in mind, let's take a closer look at why all three industrial stocks have done so well.

Data by YCharts

Old Dominion Freight Line

The trucking company specializes in a niche market of the transportation industry, namely less-than-truckload (LTL) shipping. In a nutshell, LTL means a customer's freight is combined with other shippers' freight and then transported between several terminals to its final destination. This is distinct from full-truckload (FTL) shipping whereby a customer's shipment is loaded onto a dedicated truck and then taken directly to its final destination.

Image source: Getty Images.

The key benefit of LTL is that shippers can send smaller shipments. This is a significant benefit to shippers who need to ensure a steady stream of shipments, such as securing e-commerce deliveries or maintaining inventory in a warehouse/store. Hence, it's quickly available for customers.

As such, it's not hard to see that the LTL industry has benefited from the growth in e-commerce, notably from small businesses. Also, the development of e-commerce has pressured retailers to guarantee the availability of products in-store -- good news for Old Dominion.

The company has an admirer in the leading figure in transportation in the U.S. FedEx founder and CEO Fred Smith noted on an earnings call, "they've been very brilliant in finding a niche that's, for lack of a better term, near TL. It's in that zone between LTL and TL, and their average weight per shipment in a much more dense network is about 350 pounds, 400 pounds higher. So, their margins are outstanding."

The rise of Old Dominion's share price is an example of a top-class operator focused on a niche market that has benefited from positive long-term shifts in demand. Moreover, it demonstrates what happens when a company focuses on what it does best.

Middleby

The food equipment company's astonishing performance can be attributed to a highly successful acquisition strategy. According to Middleby's SEC filings, "The company has pursued a strategy to acquire and assemble a leading portfolio of brands and technologies for each of its three business segments."

The commercial food service segment (66 different brands) sells into quick-service restaurants, convenience stores, supermarkets, hotels, etc. The food processing segment (21 different brands) sells cooking and baking equipment into food processing companies. While the residential kitchen segment sells a wide range of equipment across its 17 different brands.

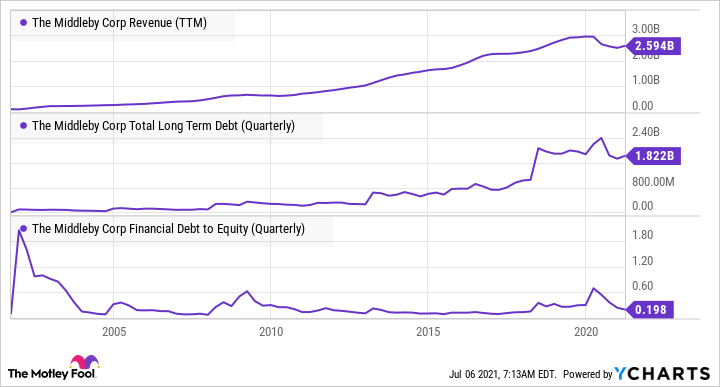

Middleby's story has been one of acquisition-led growth. Still, as you can see below, even as its debt has risen (taken to fund acquisitions), the company's debt-to-equity ratio is manageable. In other words, this isn't a story about chasing growth through reckless acquisitions.

Data by YCharts

All told, Middleby's stock success demonstrates what happens when management actively pursues acquisition-led growth within a growth industry.

Sherwin-Williams

The paint and coatings company's success speaks to a combination of the paint and coatings industry's fundamental attractiveness and the potential for growth through consolidating an industry.

As long as physical assets are created (housing, automobiles, airplanes, ships, packaging, etc.), they will need to be coated. In addition, it's a market that implies a significant amount of recurring revenue -- cars need to be repainted, houses refurbished, etc. As such, the industry's market position is stable.

Image source: Getty Images.

In addition, the leading players like Sherwin-Williams and PPG have been consolidating a highly-fragmented industry through an ongoing wave of acquisitions such as Sherwin-Williams' $11.3 billion acquisition of Valspar in 2017.

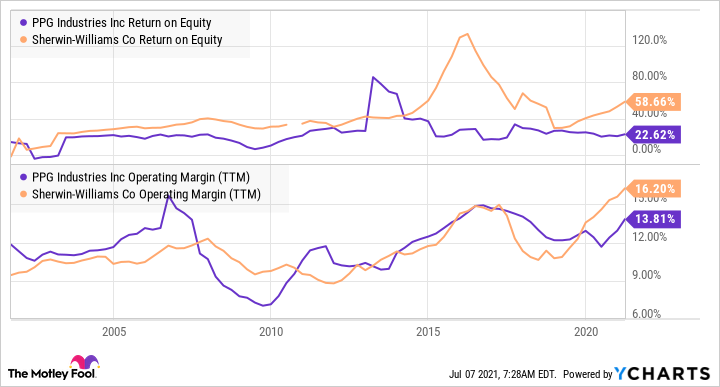

The chart below shows the high return on equity (net income divided by shareholder's equity) generated in the industry and the upward trend in profit margin that often happens when industries consolidate and build scale.

Data by YCharts

Finding the next big winner

All told, Old Dominion highlights the benefit of being a highly-skilled operator in a niche growth market. Likewise, Middleby represents a skilled management team buying growth in a growth industry, and Sherwin-Williams shows the power of consolidating a fragmented market.