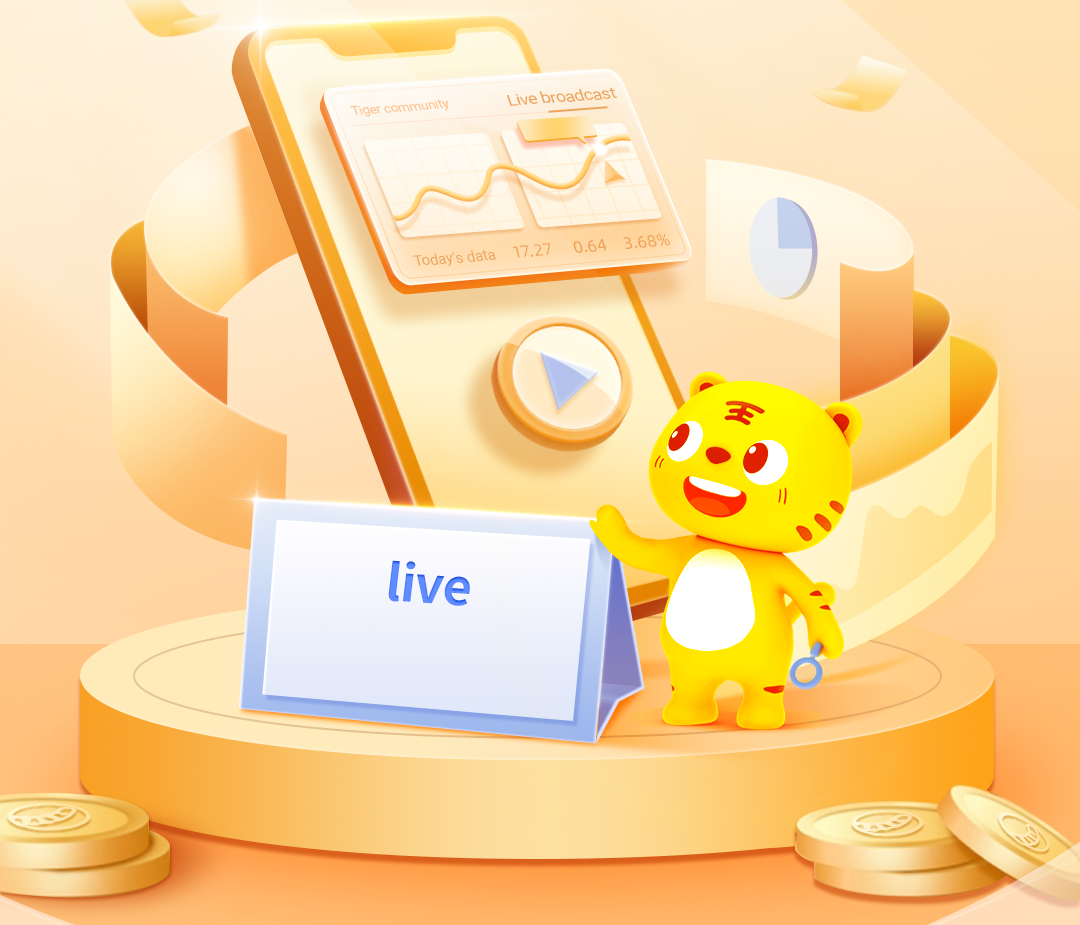

2026 is already shaping up to be a milestone year for OUE REIT! We kicked off the year with two big highlights: 🚀 Robust Core DPU growth of 13.8% for FY2025, and 🔑Our maiden strategic expansion into Sydney’s CBD prime office market, with a 19.9% interest in Salesforce Tower—a bold first step as we embark on Phase 3 of our value creation journey. Curious about what’s driving our resilient performance and how we’re building for sustainable growth ahead? Join our CEO, Mr Han Khim Siew, and CFO, Mr Lionel Chua, next Thursday at POEMS’ lunchtime webinar to hear directly from management on: FY 2025 Results and Singapore Market Outlook Phase 3 Value Creation Journey and Growth Priorities Strategic Expansion into Sydney’s CBD Prime Office – Why? 📅Date: 5 March 2026, Thursday 🕧Time: 12.00pm - 1.00p

新加坡投资圈

虎友们想了解的新加坡股市、基金等投资机会都在这里!

+ 关注

+558